CATTI证书在这个月有这个大用处!

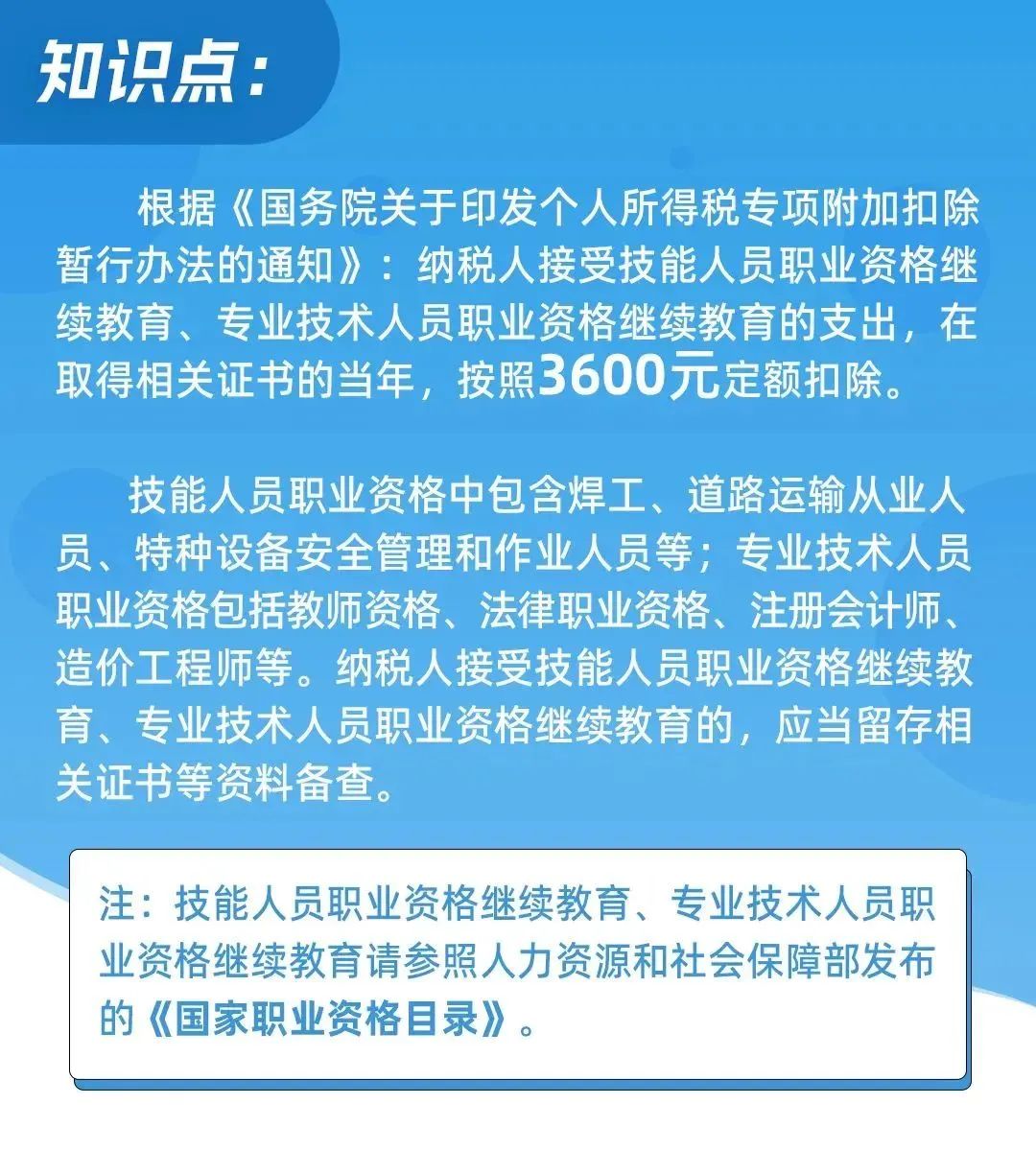

家人们 2024年个人所得税清缴已经开始啦! 激动的心 颤抖的手 更让人惊喜的是! CATTI证书也可以参与退税哦! 根据《国务院关于印发个人所得税专项附加扣除暂行办法的通知》:纳税人接受技能人员职业资格继续教育、专业技术人员职业资格继续教育的支出,在取得相关证书的当年,按照3600元定额扣除。 申报流程 打开个人所得税APP,选择专项附加扣除填报。 填报专项附加扣除页面选择继续教育。 继续教育类型选择职业资格继续教育,继续教育信息一栏教育类型选择专业技术人员职业资格,证书名称选择翻译专业资格。 退税 tax refunds 退税是指在税务方面,税务机关向已缴纳过多税款的纳税人发放的偿还或退款。个人或实体缴纳税款时,根据收入、扣除项、津贴和税收抵免等各种因素计算应纳税额。如果实际纳税额低于已缴纳税额,纳税人有资格获得超额退税。税务机关审查纳税人的纳税申报表并进行退税处理,将多余的资金返还给纳税人。

Tax refunds, in the context of taxation, are reimbursements or repayments issued by tax authorities to taxpayers who have overpaid their taxes. When an individual or entity pays taxes, they calculate their tax liability based on various factors such as income, deductions, allowances, and credits. If the amount of tax paid exceeds the actual tax liability, the taxpayer is eligible to receive a refund for the excess amount. The tax authority reviews the taxpayer’s tax return and processes the refund, returning the surplus funds to the taxpayer.

- 鉴于各方面资讯调整与变化,本站所提供的信息仅供参考,敬请以公布信息为准。

- 本站文章存在转载现象,所有转载均出于非商业性学习为目的,版权归作者所有。

- 如发现本站文章存在内容、版权、转载或其它问题,请及时联系我们沟通与处理。联系方式:liyan@peki.vip。

扫码关注

佩琪翻译学堂公众号